Planning, scheduling, and risk are critical elements in providing premium project control techniques on construction projects. Project controls for the construction industry have experienced a high level of innovation. However, in schedule risk analysis, we are still simulating schedules using only early dates, and the 1950s-era CPM algorithm and use of sticky notes for scheduling require an overhaul. Over the last decade, PMA Technologies has created new algorithms to spur innovation in planning, scheduling, and risk management. Our planning algorithms drive an interactive real-time graphical planning process, the Graphical Path Method (GPM®). Our scheduling algorithms calculate float and criticality left of the data date and allow activities to start and move anywhere between early and late start dates. Our risk algorithms allow floating and pacing of activities within the simulation, creating a much more accurate life model scenario.

As presented at the Project Control Summit, May 18–21, 2022

Tim Mather, COO at PMA Technologies

Tim Mather, COO at PMA Technologies

As COO of PMA Technologies, Tim leads the design and development team and the intellectual property efforts surrounding NetPoint. He is a certified Project Management Professional with extensive project management, software development, and marketing experience. Tim earned his bachelor’s degree from Michigan State University and pursued postgraduate study of project management at the University of Chicago.

Why Perform Schedule Simulation?

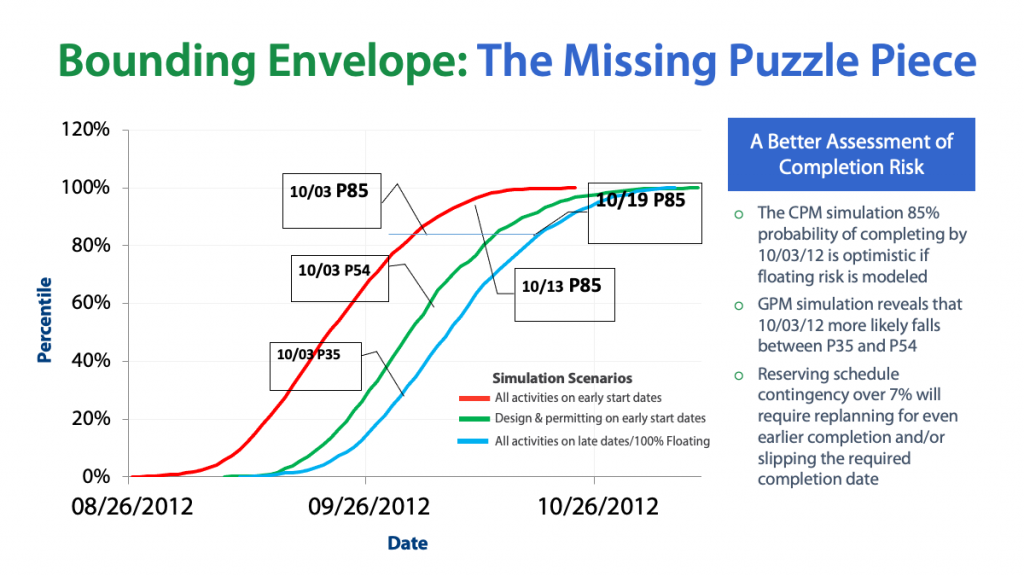

We are trying to predict the probability of project completion. This simulation produces a predicted project end date for each iteration. Over thousands of iterations, a pattern will emerge. When the pattern stabilizes, the simulation has come to convergence and the probability end dates can be charted (P dates). P dates are expressed in the percentage probability of meeting that date based on the simulation. Many large capital projects require a certain P-value (P80 for instance would predict an 80 percent chance of project completion by a certain date) before the project will be authorized. A board of directors uses the Monte Carlo results to inform their decision about committing capital to a project. The more accurate the simulation results, the better informed the decision makers will be. That is why our innovation is so important. CPM is overly optimistic and gives the decision makers bad information.

The Problem: CPM Optimism Bias in Simulation

Every CPM-based Monte Carlo simulation is based on a deterministic schedule model in which every activity starts on the early date. As we apply the Monte Carlo simulation to this model, each iteration will also start with every activity on the early date. The CPM forward and backward pass is a bulk operation that is insensible to intermediate changes to the network as the iteration progresses through the network.

The Solution: Floating and Pacing

In a GPM Monte Carlo simulation, activities can react to what has occurred earlier in their float chain. This means that the schedule model can more closely approximate what happens in a real-world project. GPM can model decision making based on progress on a chain during the simulation.